Contents

CFP graduates are much revered by professionals, industry, and even consumers. The Certified Financial Planner programme is a certain method to launch a prosperous career in asset management and financial planning. After all, the course is recognised in over 26 countries, giving it the reputation of being among the very finest available anywhere in the globe. Within the realm of finance, several experts have found themselves in positions to take advantage of numerous profitable possibilities.

This means that there is enough job security in this field it is only going to get better in the future. The CFA credential, on the other hand, can be used for both corporate roles and personal financial planning/advisor roles. Other roles that you may find Charterholders in are risk analysts, financial analysts, advisors, and traders. The Level 1 examination has a focus on investment tools (Quantitative Methods, Financial Reporting and Analysis etc.), Level 2 increases the focus on asset classes analysis (Equity Investments, Fixed Income, Derivatives, etc.). The Level 3 exam has a stronger focus on Portfolio Management and Wealth Planning. The candidates may also read this complete guide onCMA examsfor further details.

They manage the financial paperwork, update the clients with fund information, ensure that the fund follows regulatory requirements, handle client relations and answer their questions. Their responsibilities include issuing and selling securities to raise capital, conducting research and valuations to execute finance deals, and assessing and suggesting investment opportunities. They are business experts responsible for determining the potential consequences of performing a business action. Their duties include reading and analyzing financial data, creating visual models to represent possible outcomes, and preparing reports about business decisions.

Few of the colleges provide direct admission based on Class 12th marks. Few other colleges depend upon National Entrance exams for the course, Certified Financial Planner (C.F.P) in 2021. Students must keep a regular check on the official website of a college to know more about the procedures. To be eligible for Certified Financial Planner (C.F.P), a student must have passed 5 papers after their Class 12th to become a certified financial planner.

Candidates must meet the FPSB ethics and experience to pass the CFP exam. Students who have completed their matriculation and higher secondary examination and opt for a bachelor’s degree can be admitted to this course through the CFP Regular Pathway. Students who have completed CA Inter, CA, MBA, M. Com, CS, and LLB can opt for this course via the Challenge Status Pathway. Once the candidates pass the CFP exam and meet all the requirements set by the FPSB India, they will receive their certification.

CFP Certification and Eligibility

However, should you wish to print and frame your certificate from FSPB Ltd., you will have an option to do so. The National Institute of Securities Markets has accredited FPSB Ltd.’s CERTIFIED FINANCIAL PLANNER certification in India. The accreditation is valid until 4 September 2020, after which the accreditation is eligible to be renewed for two more years, subject to program monitoring and approval by NISM. With the accreditation, CERTIFIED FINANCIAL PLANNER professionals in India offering investment advice are eligible to register as Investment Advisors under Securities and Exchange Board of India regulations. CERTIFIED FINANCIAL PLANNER Certification is a mark of excellence granted to individuals who meet the stringent standards of education, examination, experience and ethics.

You should be able to process information quickly and demonstrate a lot of creativity, in terms of finding the best possible solutions according to a client’s specific needs and requirements. Having said that, one of the most essential requirements of this trade is for you to be able to personalize the experience for the client; listen to and react to their questions and concerns in the most customized manner. They are supposed to study the market for you and give you the best possible financial service offering to earn monetary profits on your investments without bearing too much risk.

Fee Structure for CFP

The registration process for admission can be carried out through both the online and offline modes. For the online procedure, students are required to visit the college website, log in their details, fill in their credentials in the application and make the online registration payment. Regarding the offline process, students need to visit the college admissions office, collect the application form, fill in the details and make the registration payment. For both the procedures, candidates are required to submit valid documents for the verification process.

Certified Financial Planner® and Chartered Financial Analyst® are the two most talked about designations in the field of finance. Both of them serve different interests, and candidates will eventually perform work of a different nature. Both may sound similar but, in reality, they serve different purposes . FREE INVESTMENT BANKING COURSELearn the foundation of Investment banking, financial modeling, valuations and more.

Certified Financial Planner (CFP) Jobs by Salary

After completing the certification programme that lasts for one year, graduates are eligible for substantial wage packages in both the public and private sectors. Both the private and the public sectors in India provide a pool of opportunities for graduates of the CFP certificate course. However, the opportunities for CFP jobs are even greater in many foreign nations. Economic development and infrastructural facilities have enabled many First World countries to provide ample career opportunities in the field of finance and investment. The growth of the economic sector in many of the West European or American nations is a testament to the job and employment opportunities available in the sectors related to CFP.

- You should prepare yourself to study topics such as the valuation of securities, investment portfolios, and financial markets.

- For certain colleges, CFP course eligibility in India is clearing the entrance test of the respective institute.

- It’s safe to say that the Job seekers in the industry has increased but at the same time finance companies have only started to grow in India.

- Commission earned from advising various financial service products like Mutual funds, insurance etc.

These requirements typically demand large amounts of less formal study in order to pass the requisite examinations. The next step is to submit an application for an internship with a financial company in order to obtain expertise in the field of marketing various types of financial goods. These products include stocks, bonds, mutual funds, and insurance policies. It is possible that during your internship, you may work directly with senior advisers.

Selection Process

Experience must be completed within five years of successfully passing your first exam. Once the documents are in order, a payment link will be sent to the candidate on their registered email id for payment of fees of $100. Award CFP certification to those who successfully complete CFP education, CFP exam and other CFP certification requirements.

FPSB Limited, US enters into licensing and affiliation agreements with nonprofit organizations around the world that allow the organizations to establish and operate the CFP certification program in a country or region. FPSB Affiliates who meet and maintain FPSB’s affiliation criteria high standards are authorized to administer the CFP certification program on behalf of FPSB in a country or region. The portfolio manager implements investment strategies and processes to meet the client goals and also construct or manage the portfolios. Finance assistants look after day to day finance related tasks in the finance department of a company.

Training with FPSB India Authorised Education Partner can give benefit of guidance from qualified CFP Professionals. With structured program plan candidates can benefit and complete the program earlier. One must remember, CFP Certification program is not an abstract theory but with real life situations .

A CFA charter with about 15+ years in the industry typically makes a minimum of INR 50,00,000 annually in India. Also the best part about CFA is that recognition starts from level- 1 itself and you can start working while prepping for level 2 and level 3. Pay is in par with other industries in the initial 3-4 years of your career but it starts to grow exponentially once you reach a certain level.

A CMA-certified candidate is eligible for higher positions in the company. The relevancy of the certified courses can be determined by the structure of the course and the practical lessons it imparts. The CMA curriculum is designed specifically to mirror real-world applications that are in practice in the financial and accounting sector. Hence, CMA designation holders are paid 58% higher compensation than their non-certified counterparts as indicated by IMA’s 2021 Global Salary Survey. We all know how well the banking industry pays, one of the most highly paid industry is banking.

Join Over 500,000 Students Enjoying IMS Proschool E-Learning Education Now

This results in an array of opportunities as it is not confined to just equity or bonds or real estate or derivatives. The salary information presented on this page is based on all Certified Financial Planner jobs published on Jobted in the last 12 months. IMS Proschool is the market leader in delivering exceptional career-building courses using intensive professional certifications. The CFP Course is 12 to 18 months program and can be pursued along with college or job. Proschool takes pride in being one of the finest education providers for the CFP program.

76% of firms found that employing CFP professionals led to increased client retention. 69% of firms reported that CFP professionals have a higher rate of growth of assets under management. https://1investing.in/ 69% of firms reported that employing CFP professionals lowered corporate risk. 59% of firms reported that employing CFP professionals led to fewer client complaints.

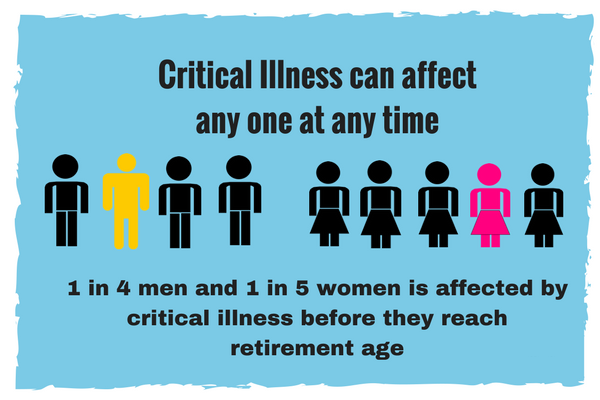

It’s a dream for everyone to retire early and enjoy their life with their loved ones. But to retire early, a person needs to accumulate enough wealth so that he/she doesn’t have to be dependent on any other person. A financial planner helps in retirement planning in 2 ways – advising which scheme to invest in (such as NPS, APY, PPF etc.) & how much to invest at each life stage and ensure that the wealth lasts throughout the lifetime. Their cfp scope in india responsibilities include preparing or interpreting financial document summaries, investment performance reports, and income projections for clients, managing and regularly updating clients’ portfolios, etc. They use data analysis and advise senior managers on profit-maximizing ideas, which can help optimize company profits over time by making intelligent decisions for investments or spending funds to have the greatest return on investment.

CFP Certification is the leading Certification globally in the field of Financial Planning with over 1,70,000 Certificants. For those looking for a career in the financial services sector, CFP Certification provides a definite edge over other candidates and is widely respected by consumers, professionals & industry. He would want to invest Lakhs of Rupees in a way that would earn him Crores of Rupees. A financial planner, in this case would turn into a wealth manager and he/she would be looking for opportunities to invest the client’s money in MNC’s, real estate etc. which give large returns.

The experts have estimated that India would need more than qualified financial planners in the coming years. Several advanced financial planning, financial decision making, case studies books and modules have to be studied in order to attempt this examination. Entrepreneurship is another great option with the CFP certification exam. Clients will develop an amount of trust in you with their financial products only when they know you are certified and understand the ins and out of your trade like no other.