Hence, the final investment decision shall at all times exclusively remain with the investor alone and BFL shall not be liable or responsible for any consequences thereof. Large-cap funds are those equity mutual funds that invest in the equity & equity-related securities of the Top 100 companies in terms of market capitalization. These companies have strong balance sheets, large market shares & organized management which makes them leaders in their sectors. If you need assistance or advice to make a productive portfolio for your investment in axis equity fund g, you can avail our services anytime. The annualised returns of the axis equity fund growth scheme for three- and five-year investments are 11.4 and 13.5 percent respectively.

Why is Axis Blue Chip fund not doing well?

This fund is managed with a growth-oriented approach, and post Covid, growth style of investing has been out of favour. This resulted in the fund delivering a rather underwhelming performance in 2021 and this year so far.

World-class wealth management using science, data and technology, leveraged by our experience, and human touch. The minimum sip amount for Axis Bluechip Fund is ₹1000. Also, for dividend income in excess of Rs 5,000 in a financial year; the fund house shall deduct a TDS of 10% on such income. Get the best filtered funds based on our pre-defined screeners. Average return generated by the fund during a specified period. Cover arranged by Axis Bank for its customers under Digit Illness Group Insurance Policy .

Mutual Fund units are issued to a few designated large participants called Authorised Participants . AUM or Asset Under Management is the total value of the assets held by a Mutual Fund scheme. For instance, for an equity Mutual Fund, the AUM will be the total value of its portfolio’s equity shares . The AUM of the fund changes every day because the price of the underlying asset fluctuates daily. However, the Mutual Fund company doesn’t update it every day.

Add to Portfolio

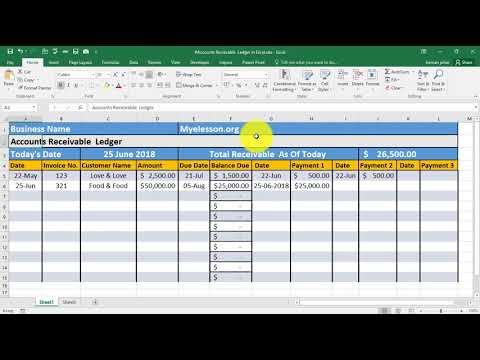

The equity shares of Axis and ICICI funds are 95.8% and 89.7%. ICICI fund has an attractive P/E ratio absolutely due to more diversification. Both Axis and ICICI bluechip funds have the majority of equity exposure and few cash instruments.

The fund can be a good investment for an investor’s core equity portfolio. The axis equity fund g investment process is embedded with risk management techniques. The Rate of Return also known as the Return of Investment is the basic fundamental ratio of calculating returns for any gains or yearly income. The Return Calculator lets you calculate your proxy returns using various combinations across different mutual funds and time frame. Axis Asset Management Company Limited manages assets worth 247,279 crores and was set up on 13 January 2009. It’s current offering of mutual fund schemes includes 30 equity,107 debt and 32 hybrid funds.

This is the annualised growth rate assuming monthly compounding. Axis Bluechip Fund is a Large Cap Equity fund and has delivered an annualised return of 11.2% over a period of 13 years. The fund is managed by Axis Asset Management Company Limited. The fund managers are Hitesh Das, Shreyash Devalkar, Vinayak Jayanath. For units redeemed after 1 year of investment, gains of upto Rs. 1 lakh accruing from those units in a financial year shall be exempted from tax.

The fund has doubled the money invested in it every 6 yrs. Axis Bluechip Fund is a Large Cap Equity scheme predominantly investing across Equity instruments with an investment objective to generate wealth over the long term. Click here for top ranked funds in large cap mutual funds. Beta shows the portfolio risk in relation to the market. A beta of less than 1 means that the fund returns are less volatile compared to the broader market. A beta of more than 1 means that the fund returns are more volatile than the broader markets.

Past performance of the schemes is neither an indicator nor a guarantee of future performance. Large cap funds provides inflation beating growth over the long term and is suitable for investment objectives with duration of years or longer . Investors looking to invest in equity funds with relatively low volatility could consider investments in this fund.

Scheme Riskometer

Equity funds can be divided based on the market capitalisation, sector/theme. The minimum SIP amount for Axis Bluechip Fund is ₹1000 and you can increase this in multiples of ₹100. In case you want to invest a lump sum, the minimum amount to be invested is ₹5000. Check your estimated returns on mutual funds by using sip calculator. Multicap has a diversified portfolio by investing in large, mid and small cap.

What is the 5 year return of Axis Bluechip?

1. Current NAV: The Current Net Asset Value of the Axis Bluechip Fund as of Mar 24, 2023 is Rs 40.71 for Growth option of its Regular plan. 2. Returns: Its trailing returns over different time periods are: -7.13% (1yr), 15.88% (3yr), 10.78% (5yr) and 11.25% (since launch).

It is updated only at the end of the month and released within few days of the next month. Axis Bluechip Fund is rated as a 1 fund in Equity and delivered -7.8% returns in the last 1 year. Scripbox provides a compare mutual funds research tool to view a detailed comparison with Axis Bluechip Fund . Absolutely not and this is what most of the customers end up doing. The fact is that nobody can predict when the markets will be up or down. SIP provides rupee-cost averaging, and hence it should not matter if the markets are up or down.

When it comes to mutual funds there is a general misconception that investing in mutual funds means investing in stocks. This entirely depends on the investment horizon and risk taking capacity of an individual. SIPs generally work best for equity and equity-oriented hybrid funds given that these are prone to market fluctuations. However, for investment discipline, axis bluechip fund graph one can also invest in debt funds also. Investments in Axis Bluechip Fund can be made by investors who want to invest in established entities with a track record of excellent performance for a long period of time. The large size of the underlying holdings makes investments in these funds relatively stable as compared to investments in other equity fund categories.

Axis Bluechip Fund-Reg(G)

Gains are taxed at a rate of 15% (Short-term Capital Gain Tax – STCG) if units are redeemed within 1 year of investment. While the top 10 equity holdings constitute around 59.16% of the assets, the top 3 sectors constitute around 56.46% of the assets. A fund with a higher Treynor ratio is considered better than a fund with a lower Treynor ratio.

- The axis bluechip fund growth SIP investment is the best alternative that can be opted by an investor in order to gain high growth of capital in the long run.

- Axis Bluechip Fund Direct Plan-Growth returns of last 1-year are -6.79%.

- It is an indicator of how quickly fund managers buy and sell the specific assets and securities within the fund in a specified period.

- Absolutely not and this is what most of the customers end up doing.

The most important thing to remember is to stay invested. This increases the potential to build wealth over a period of time. With SIP, you don’t need to worry about timing the markets. Just stay invested irrespective of the market conditions. In doing so, you end up getting more units when the price is low and fewer units when the price is high. This in turn leads to a lower average cost per unit over time which is also called as rupee cost averaging.

Ratios are calculated using the calendar month returns for the last 3 years

Axis bluechip fund can be started by investing Rs. 500 minimum as SIP. There are only a few actively managed large-cap funds, which have outperformed the Nifty 50 Index. These two funds have been outstanding from Nifty 50 for the last 1,2,3,5 year and from inception. Axis Bluechip Fund Direct Plan-Growth scheme return performance in last 1 year is -6.79%, in last 3 years is 74.84% and 273.45% since scheme launch.

What is the current position of Axis Bluechip fund?

Axis Bluechip Fund Direct Plan-Growth has ₹33,050 Crores worth of assets under management (AUM) as on 31/12/2022 and is medium-sized fund of its category. The fund has an expense ratio of 0.63%, which is less than what most other.

Redeeming your investments in Axis Bluechip Fund is super easy. If you have invested in this fund via ET Money, just login into the app, go to the investment section and put the redemption request. This indicates the fund has not generated great returns and even those are not very consistent. You might want to look at other funds in its category. The Axis Bluechip Fund is a 10 yrs 2 m old fund and has delivered average annual returns of 13.73% since inception. The expense ratio of the Axis Bluechip Fund is 1.7% for regular plan.

The use of any information set out is entirely at the User’s own risk. Axis Bank does not undertake any liability or responsibility to update any data. No claim (whether in contract, tort or otherwise) shall arise out of or in connection with the services against Axis Bank. The Expense Ratio of a Mutual Fund is the annual charges you pay to the Mutual Fund company for managing your investments in that fund.

At the bottom of the table you’ll find the data summary for the selected range of dates. If you have invested in Axis Bluechip Fund from anywhere else, you can go to the fund house website and put a request through it. The Expense Ratio of the direct plan of Axis Bluechip Fund is 0.63%.. NAV or Net Asset Value is the per-unit price of the Mutual Fund. It is calculated by taking the current value of the holdings of the fund at end of the day, subtracting the expenses, and dividing the value by the number of units issued to date. As per SEBI’s latest guidelines to calculate risk grades, investment in the Axis Bluechip Fund comes under Very High risk category.

Is Axis Bluechip fund good?

Over the past 10 years, Axis Bluechip has been the third-best performing fund among its peers and has delivered a CAGR of over 15%. The average returns of all funds are around 13% for the same period. If we compare year-on-year performance with its category, the fund has delivered outperformance in most of the years.